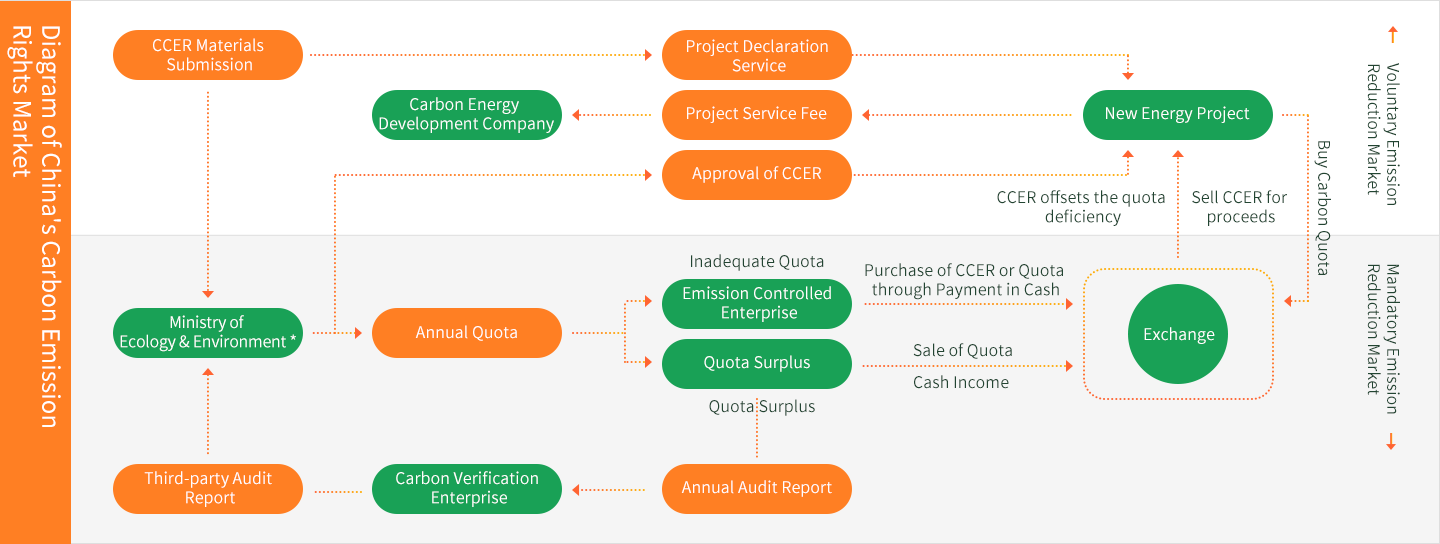

A carbon trading market will be launched, meaning that energy conservation and carbon reduction will rely more on market-based instruments. Once the carbon market is launched, businesses involved in the carbon trading can use distributed PV commissioning to promote comprehensive measurement of various management indicators.

Based on the virtual power plant operation strategy and the integrated energy system, the Company will monitor and collect energy consumption data of industrial enterprises, use big data mining and analysis technologies, and extend the functional application of the integrated energy system.